"INSCOIN" Blockchain-Based Insurance Company First "

Here I will describe "INSCOIN" as the first Blockchain Insurance Company in financial institutions and create the most efficient and sophisticated structure.

About InsCoin for Project Knox

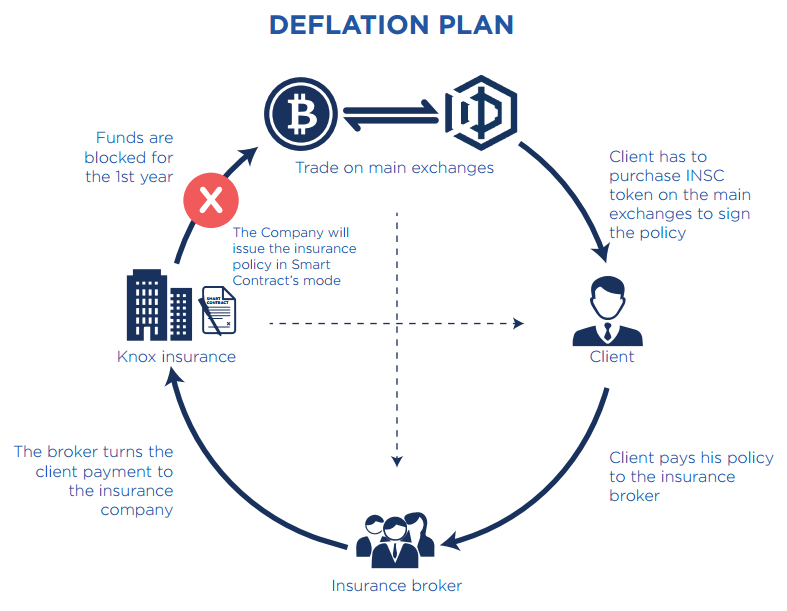

"InsCoin for Knox Project" aims to establish the first insurance company to receive Crypto (INSC) for insurance premium payments, and the first, with the help of blockchain, will solve the problem of counterfeiting insurance policies.

The KNOX Project will be the first insurance company to combine the real world with the digital world using Blockchain technology, creating the most efficient and sophisticated structure in the sector, to find solutions to certification and anti-counterfeit insurance policies. This will be the first time issuing insurance policies in the form of smart contracts and traditional paper.

With smart contracts, the spread of fake insurance policies is avoided because it is the same system that issues them upon receipt of payment.

With smart contracts, the company will not have any delay in collecting credits, since the policy is issued only after receiving payment. This factor aims to improve the company's management significantly.

With smart contracts in the event of an accident, real judges who will decide whether or not to pay them are no longer a company, which could have opportunistic behavior, but a blockchain system that, in absolutely no interest in human opinion, will decide whether the accident is in accordance with provisions in the policy.

This benefit will be the most important because it will increase the company's transparency to customers.

The INSCOIN project intends to use, among many available, the Ethereum blockchain, which currently presents the largest number of real cases in use and the service economy and transactions currently in operation. Ethereum provides, using ERC20 infrastructure and technology, the creation of digital personalized coins from token publishing that allow to support entrepreneurial projects. Token sales allow the company to gather the necessary economic resources for project development where the token itself will play a key role. Token in this sense allows the possibility of new technologies that offer innovative services.

KNOX's goal is to achieve, by utilizing blockchain, the decentralization of the entire insurance system. Decentralization means the transformation of traditional insurance policies from paper into smart contracts.

With smart contracts, the spread of fake insurance policies is avoided because it is the same system that issues them upon receipt of payment.

With smart contracts, the company will not have any delay in collecting credits, since the policy is issued only after receiving payment. This factor aims to improve the company's management significantly.

With an intelligent contract in the event of an accident, the actual judge who will decide whether to pay is no longer a company, which can have opportunistic behavior, but the chain block system will decide whether the accident is in line with the policy. This benefit will be the most important because it will increase the company's transparency to customers.

Info Token

Token - INSC

Platform - Ethereum

Type - ERC20

PRICO price - 1 INSC = 0.0002 ETH

Price at ICO - 1 INSC = 0.0002 ETH

Pre-ICO begins - June 23, 2018

Pre-ICO ends - July 7, 2018

Bonus - Available

Investment info

Min. investment0.1 ETH

Receive - ETH

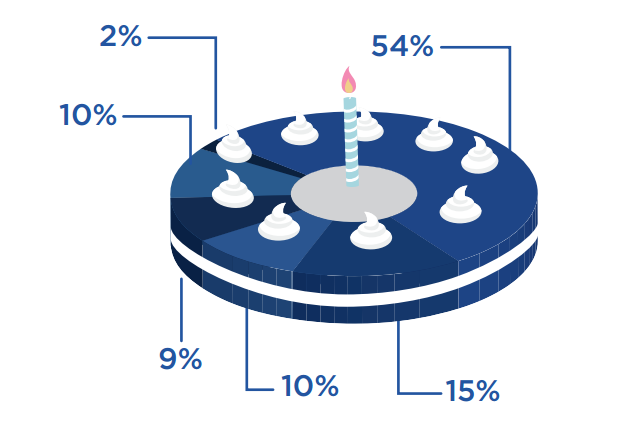

Distributed in ICO - 54%

Soft cap - 4,000 ETH

Hard cap - 39,444 ETH

Token on sale - 270.000.000

Unallocated tokens will be burned after the ICO ends.

INSCOIN tokens are a fundamental part of our project. Through it the customer can pay the insurance premium and can access the maximum level of authenticity of the policy, receive it in the form of smart contract.

Inscoin's supply will be 500,000,000 and will be distributed like this:

Sales Token 54%

15% Reserved blocked (WholeSaler Broker)

10% Team and Advisor

9% Reserves are distributed to 3 Insurance Companies (blocked for 3 months and 10% monthly release)

10% partnership Network Brokers, Legal Advisors and Insurance

2% Airdrop and Bounty programs

Roadmap

Realization of study project (MARET 2017)

Team Building

Establish the first collaboration network

Business Plan Forecasts (MEI 2017)

Legal consultation

Invest € 150,000

IT Insurance licensed platform (JULY 2017)

Invested € 300,000 for certified insurance platform

Insurance partnership (OCTOBER 2017)

Partnership with over 300 insurance brokers ready to work with the company

ICO Planning (FEBRUARY 2018)

ICO planning and marketing plan development

PRE-ICO (JUNE 2018)

Starting from PRE-ICO

ICO (JULY 2018)

Starting from ICO

Trading inscoin at major exchanges (SUMMER 2018)

InsCoin will be listed on the main exchange to ensure easy implementation for the company's future customers and the exact volume compared to our revenue.

Compliance to obtain an insurance license (AUTUMN 2018)

We will get authorization from the authorized authorities of the three countries to provide legal insurance services.

Introduction to internal platform (WINTER 2018)

With that customers will be able to access their policies through smart contract.

Smart contract in insurance business (WINTER 2018)

Smart contracts will increasingly become the protagonists of the insurance industry

For more information please visit and join on our link below:

WHITE PAPER: https://inscoin.co/#whitepaper

ANN THREAD: https://bitcointalk.org/index.php?topic=4422850

WEBSITE: https://inscoin.co/

TELEGRAM: https://t.me/inscoinico

STEEMIT: https://steemit.com/@inscoin

FACEBOOK: https://www.facebook.com/Inscoin-for-Knox-1802470656458272

TWITTER: https://twitter.com/INSCOINforknox

LINKEDIN: https://www.linkedin.com/company/inscoin-holding-ou/

Bitcointalk Username: deniyoga

Bitcointalk URL: https://bitcointalk.org/index.php?action=profile;u=1978689

My Etherwallet: 0x7D272F921C250d92ed01FD8eDb5fB315C41770bC

Comments

Post a Comment