Decentralization Platform for Household Property Financing Based on the Peer-to-Peer Blockchain

Preface of the project

Homelend is a platform for mortgage financing for the next generation of distributed home buyers. Homelend creates an interface for direct interaction between borrowers, lenders, and others involved in the mortgage value chain. This allows mortgage financing of the crowd using the peer-to-peer, transparency and automation models provided by ledger distributed technology (DLT) and smart contracts.

What is a home link platform?

Homelend connects borrowers and lenders in a unique way that does not involve intermediaries but is controlled by a wise agreement. The Borrower will apply for a mortgage loan through the Homelend platform.

This application is checked and approved (or not applicable) through machine learning and artificial intelligence techniques. Each creditor can then buy "irises" to increase pre-approved loan funds.

All processes are controlled by intelligent non-human contract protocols. On the Homelend platform, information gathering is "all-digital".

Even data in paper-based documents should be transferred to a distributed storage-based digital storage technology.

This data is provided by the user and verified through a professional verification provider.

Homelend financial flows, borrowers (ultimately sellers) of financial resources flow from pure lending institutions run by pure contracts. Homelend's services, control or financial decisions.

Once a buyer receives a pre-approval from the system, they receive a mortgage on the mortgage platform with respect to a particular property.

Therefore, the borrower will make a certain face and the amount of credit will be determined.

Business model

Home Links are being developed as a block-chain solution that will greatly increase the likelihood of home financing for many individuals and families. Our value proposition for sensitive societies and progressive approaches has settled on peer-to-peer networks that use technology.

Nevertheless, Homelend is based on a sound and profitable business model, and is well aware of the markets that are lacking in the market model. Homelend, on the other hand, creates investment opportunities for real estate with innovative technologies such as blockchain. On the other hand, many individuals, including the current limitations of traditional credit risk models,

Advantage Home Run

* Long, streamlined & efficient in documentation

Homelend implements end-to-end process autocompletions that reduce business processes from 50 to 20 days by inserting business logic into smartly configured contracts, digitizing documentation and eliminating unnecessary processes.

* From inefficient and cost-effective intermediaries

Because of the certainty, security, and transparency that DLT provides, you can record transactions, including loans, without a bank acting as an intermediary. This fees for the borrower and lender while minimizing the distance between them.

* From ambiguous & clunky to transparent and easy to use

Homelands aims to create a simple and fair loan process as well as being smart. This allows the Borrower to apply for a loan at any time, track the status of the application at any time, and interact directly with the mortgage lender.

* From reliable, credible and credible

The paper-based processes and centralization are key factors in the anxiety and vulnerability that characterize the traditional mortgage industry. Thanks to the unique nature of DLT and a smart agreement, Homelend can provide a platform where people can trust, be transparent, and securely trade a lot of money.

Token Home Run (HMD)

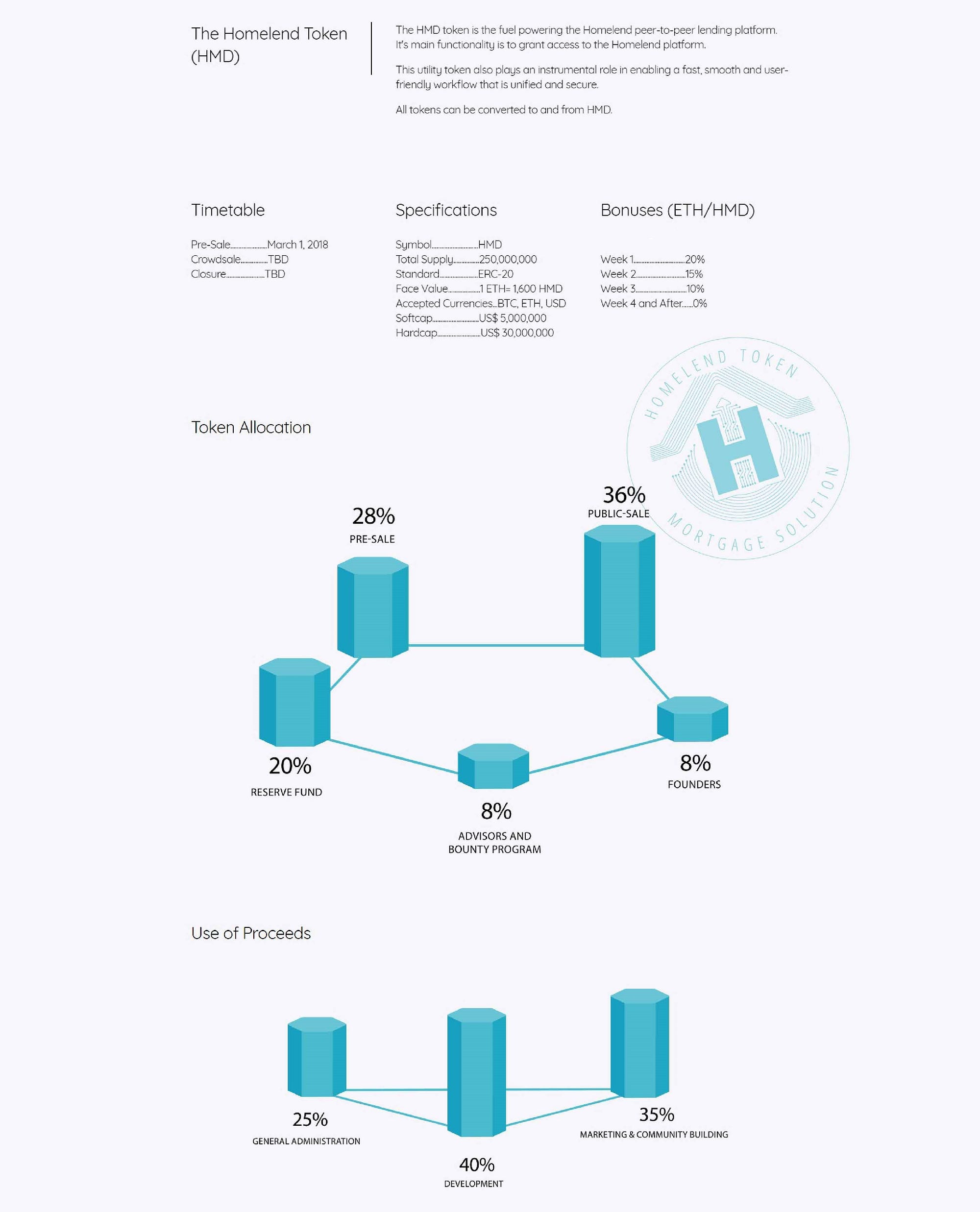

The HMD Token is a fuel that supports Homelend's peer-to-peer loan platform. Its main function is to provide access to the Homelend platform.

Tokens This utility plays an important role in implementing and maintaining an integrated workflow that is fast, smooth, and user friendly.

All tokens can be converted to HMD.

* Specification

Symbol: HMD

Supply: 250 million +

Standard: ERC-20

Nominal value 1 ETH = HMD 1,600

Currency: BTC, ETH, USD

Soft stamp: US $ 5 million

Hard stamp: US $ 30 million

* Allocation of Token

28% of pre-

36% General Sale

Reserve Fund 20%

8% of advisors and bounty programs

Founder 8%

* Continue to be used

25% General Administration

40% Development

35% from the public and architectural marketing

This token utility also plays an instrumental role in enabling a fast, smooth, and easy-to-use workflow that is integrated and secure. All tokens can be converted to and from HMD.

Pre-Sales Schedule ............. March 1, 2018

Crowdsale ................. Closure of TBD ............ TBDSpecifications Symbol ................. ............

HMD Total Supply ................ 250,000,000

Standards ........................

Face Value ERC-20 .................... 1 ETH = 1,600

Currency Received by HMD ... BTC, ETH, USD

Softcap .............................. US $ 5,000,000

Hardcap. .......................... US $ 30,000,000Bonus (ETH / HMD) Week 1 ............ .................... 20%

Week 2 ............ ................... 15%

Week 3 ........................... ..... 10%

Week 4 and After ....... 0% Crowdfunding Homelend Mortgage Platform We Develop Decentralized Mortgage Loans Platform.

Peer-To-Peer Serves Two Purposes

* Modernize the old-age mortgage loan system to be efficient, cost-effective and custom-centric.

* Expanding home ownership opportunities for a new generation of borrowers, fulfilling their different lifestyles and needs.

Conclusion: Like all investments, you have to do your own research. The information provided in this article focuses primarily on bringing the facts from white paper to complete your due diligence. Please do your own research and make your own thoughts.

If you want to be closer and clearer, please ask Homelend's official source below:

Bitcointalk Username: deniyoga

Bitcointalk URL: https://bitcointalk.org/index.php?action=profile;u=1978689

Comments

Post a Comment