BLACK INSURANCE MARKETPLACE FOR INSURANCE,BROKERS AND INVESTORS ON BLOCKCHAIN

BLACK INSURANCE

A globalized and decentralized platform, used to manage cumulative points and loyalty programs. Analysis of a large number of different loyalty programs using points, the developer did not find a good application. This leads to direct damage to users, as well as loyalty programs not successfully implemented and increasing liabilities to the company.

Black will fundamentally improve the insurance industry. Black is an insurance platform like Lloyds of London in blockchain at no cost, delay and bureaucracy we are witnessing today.

The insurance business will be generated by a local MGA / Broker / Agent responsible for designing insurance products for the market, setting prices and selling products and managing claims handling. Delegating a business to a local agent creates a measurable Black business model while bringing business decisions closer to the end customer.

The Challenge

One of the most concerning issues in the insurance business is that the items outline and client are too far separated. Right now the items are made by insurance agencies. This implies there are a few gatherings between the clients and items, the framework considers a ton of organization, high expenses and blocks advancement. Time to showcase ordinarily takes years.

Re-guarantors, Insurers, MGA's, Agents, Brokers, Third Parties and Wholesale Brokers. As items are controlled by safety net providers, propelling a protection items need a considerable measure of time and the business sectors. While insurance handles that are near the client and really comprehend the market can not get the coveted item to advertise sufficiently quick. There will be a great deal of arrangements, time and costs included. Regularly extraordinary thoughts get disregarded inside and out

Our Solution

Black will be a licensed insurance company that provides insurance capacity to Agents, Brokers and MGAs (hereinafter "Brokers") enabling them to launch their own virtual insurance companies. Our capacity comes from the traditional overheads of insurance company while using blockchain as main platform to get rid of centralized insurance companies.

We connect the idea to the capital directly, replacing the parties that are not needed in the value chain with technology. We will do this through crowdfunding, also giving small investors a way in. This leaner model gives more responsibilities to insurance brokers and control over the products they are selling. Insurers as we know them today is a trusted third party - blockchain gives us an alternative to that and the need for insurers disappears.

Cost Analysis

We've done an analysis of data on the insurance companies worldwide. We will show that the costs of occurring for standard insurance companies that Black would almost eliminate, are quite significant. We have gathered financial data from various international and Estonian insurance companies

between 2013 and 2016. The data shows that administrative expenses are quite high in the industry, so there is a lot of cost cutting possible. It also makes sure that the companies do not pay for their gross written premiums.

Insurance companies have costs for admin expenses and net profit of Gross Written Premium. The industry average is 20%. This is calculated by taking the average sum of the admin and net profit margins data from insurance companies provided in this blog post.

Black collects fees from users for using the platform for different actions. For example: syndicates fund an insurance product with capital. Black Insurance's fee will be a% of the GWP (Gross Written Premium). Fees to be paid in BLCK tokens. Black Foundation will sell the to market to cover costs of operation: Development, HR, admin, legal & marketing. A surplus of tokens will be in the company reserve for occasions when costs rise and use of the platform is lower.

TOKEN

Black Insurance will use two types of tokens:

Black Platform Token (BLCK). BLCK empowers infrastructure, provides access to the platform and for voting on the print system platform (token utility). All platform users will use BLCK to manage Black's personal platform, and demand for BLCK will increase as more and more insurance businesses are done on the platform.

Black Syndicate Tokens (BST) (settlement platform is not ready). BST is an investment in insurance capital, and BST is specially made for each syndicate (token), Profitability insurance portfolio for a particular syndicate will be forwarded to the holders of the BST.

FINANCING Black Insurance

Hard cap $ 45M Use of Token funds & Distribution

Token Symbol: BLCK

Soft Cap: US $ 2,000,000

Hard Cap: US $ 45,000,000

Maxsimum supply assuming that all tokens are sold with maximum discount: 471,082,089

ICO structure:

Pre-Sale Starts - 7/31/2018

Pre-Sale Period - 30

Pre-Sale Cap - $ 15,000,000.00

Pre-Sale Terms - First week 25% bonus and after first week 20% bonus

Token Sale Starts - 8/31/2018

Token Sale Period - 30 days

Soft Cap - $ 2,000,000.00

Hard Cap - $ 45,000,000.00

Token Symbol - BLCK

Total Number of Tokens - 471,082,090

Exchange Rate - 1BLCK = 0.2 USD

Minimum Purchase - $ 100.00

Accepted Cryptos - BTC, LTC, ETH

Adjustability - Undistributed tokens will be destroyed by token contract.

Listing - BLCK tokens will be listed on crypto exchanges

Token Holder Benefits - BLCK can be used to pay for services on Black platform. Black will guarantee that until 1st of January 2021 service fees paid with BLCK will be at least 20% cheaper than service fees paid in any other currency.

Token Trade Limitation - Only Team and Advisors have vesting and sales lock-in periods

Our Road Map

Oct - Nov, 2017 Ideas and teams are organized.

Nov, 2017 The product concept is ready.

December, 2017 Seed Financing.

May, 2018 MVP Launched.

Summer, 2018 ICO general sales.

December, 2018 Platform launched.

Summer, 2019 EU license.

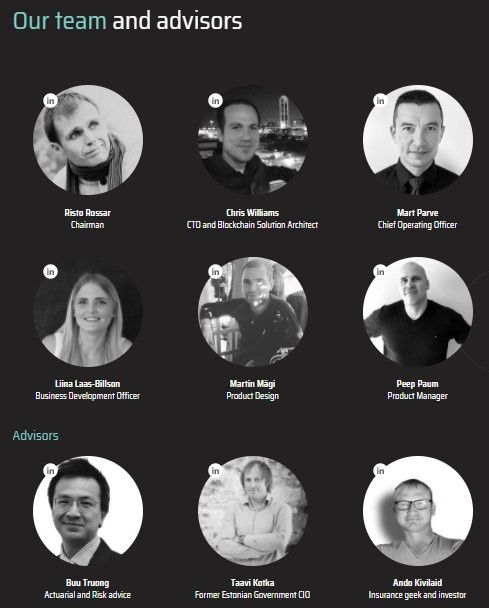

Team

The team consists of insurance industry veterans and blockchain experts. It is a great mix of inside knowledge of the insurance industry, expertise on blockchain technology and the crypto space. Founders have over 18 years of experience in insurance software and saw the pressing need for a solution that would democratize the field through technology.

Counselor

Lightpaper: http://www.black.insure/wp-content/uploads/2018/03/Black-insurance-lightpaper.pdf

Whitepaper: http://www.black.insure/whitepaper/

Twitter: https://twitter.com/BlackInsure

Facebook: https://www.facebook.com/blackinsure

Telegram: https://t.me/blackinsurebot

Bitcointalk: https://bitcointalk.org/index.php?topic=3372186.new#new

Linkedin: https://www.linkedin.com/company/black-insurance/

Bitcointalk Username: deniyoga

Bitcointalk URL: https://bitcointalk.org/index.php?action=profile;u=1978689

My Etherwallet: 0x7D272F921C250d92ed01FD8eDb5fB315C41770bC

Comments

Post a Comment